Some of the best chart patterns that are used by traders are

#Falling wedge pattern software

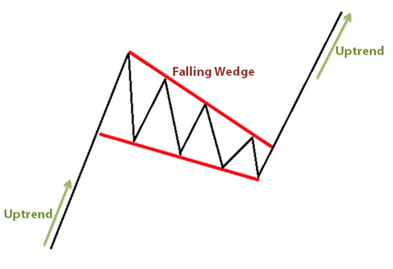

Once the pattern is spotted by the software traders can then validate them according to the price action and further analysis using technical indicators if and when required. However, traders could use this software to assist them to identify the patterns initially. Much software is available in the market these days which is capable of scanning a chart and identifying the patterns automatically. The final decision to trade must be based on validation by the price action. So it is highly recommended that traders study the patterns and their components clearly and trade using the patterns after understanding the underlying theory behind them. On the other hand, some chart patterns have a good success rate in identifying the take profit and stop loss levels, which others have a relatively lower success. Furthermore, chart patterns have a varied level of success some patterns tend to occur frequently while others don’t. But other patterns provide clear targets for take profit levels and also provide the best stop loss scenario. There are many chart patterns that primarily detect if the next move is Bullish or Bearish. The validation of the price pattern confirms whether the trader should indeed trade in the recommended trade direction. Price action is key for the success of pattern trading. But the final component is to validate that move using price action. The success of trading patterns lies in identifying them and then using the predefined rules to ascertain the next move. But, most of the time they behave in a similar fashion. Patterns have varied levels of success in identifying the next price move. So technical analysts observe the patterns and train themselves by defining certain rules. Patterns can be found in almost every chart however, it is difficult to spot them and needs trained eyes. For best trading results traders combine the charts patterns with other indicators and decide their next moves based on the confluence. However, other technical traders consider chart patterns as an integral component of their trading system or trading strategy.

So a group of technical analysts called chart pattern traders to use these patterns primarily to decide the next price move. The price behavior upon the occurrence of these patterns is almost similar and measurable.

Almost all chart-based traders agree that price moves in certain patterns and they occur repeatedly in a certain fashion which can be defined using few rules. Chart traders or technical traders use chart data to analyze, understand and predict the price movements of the market. (Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own.The quest to analyze the data and predict future price movements is the core of the financial analysis. The level of Rs 2,050 would act as major support for the counter on the downside,” recommends Sawant. “Based on the price action and technical parameters we expect the stock to move higher towards Rs 2,400 levels. The RSI indicator on the weekly has formed a higher low, indicating bullish momentum. We witnessed strong participation in volumes in every rise of the stock indicating strength in the positive move,” he said. “Prices have given an upward breakout from the ‘falling wedge’ pattern on the weekly time frame. We can also observe change in the polarity by the prices around Rs 1,900 levels,” Vidnyan Sawant, AVP - Technical Research, GEPL Capital, said. “On the weekly charts, we can spot that prices have shown a bounce back from the level of 38.2 per cent retracement of prices prior advance, Rs 895 level (March 2020) till Rs 2,589 (November 2021).

0 kommentar(er)

0 kommentar(er)